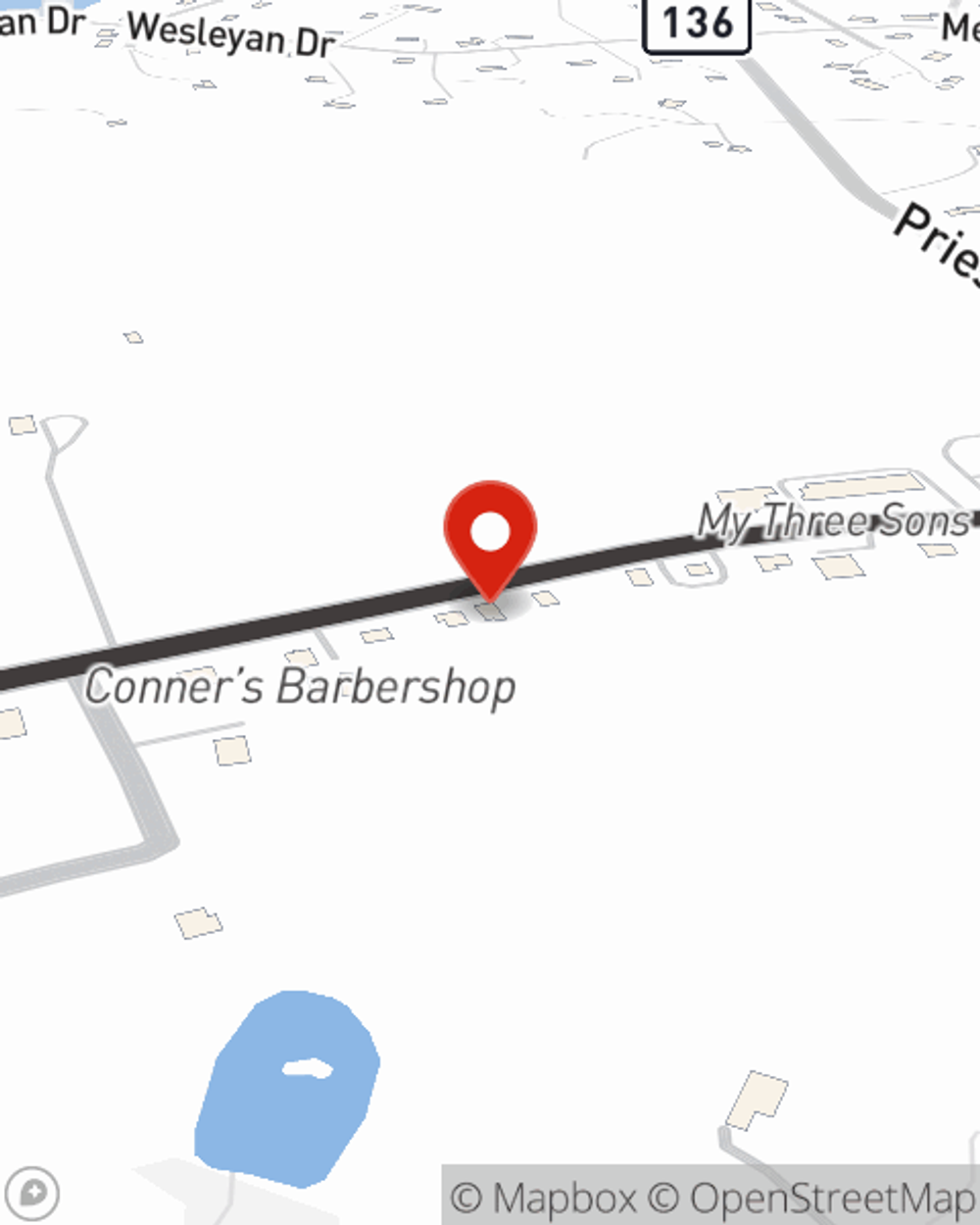

Business Insurance in and around Churchville

Looking for insurance for your business? Look no further than State Farm agent Karen Michaels!

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Running a small business is hard work. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, specialized professions and more!

Looking for insurance for your business? Look no further than State Farm agent Karen Michaels!

Almost 100 years of helping small businesses

Keep Your Business Secure

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, business owners policies or commercial auto.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Karen Michaels's office today to discover your options and get started!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Karen Michaels

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.